We all come up with questions about How Net Worth of a person is calculated? or How do you calculate someone’s Net Worth? If you ever found asking things like that then we are here to help you to calculate your net worth and more importantly, we are also providing you a Free Excel Template to calculate your net worth very easily.

Where I made the 2 sections for assets and liabilities so it will be easier for your to-do your maths according to the categories.

In simple words, Net worth is just a measurement of the wealth of a person or an entity(company, institution, or organization). It is used to measure the amount of property the person likes, cash, amount of money in the bank, shares, stocks, mutual funds, or any other property that has value.

In short, to calculate your Net Worth there is a bunch of ways to do that whether using Net Worth tracking apps or using the old Excel method, which we are going to do in this blog.

To calculate net worth you just have to add all the properties of the person or entity purchased from his earnings and subtract the liabilities or debts you have.

First, make a list of everything you have or own that has value. Keep in mind – the value isn’t what you paid for something. It is what you could sell it for.

I’ll give a free worksheet template for your Desktop like which will work on Excel for more advanced Accounting, thereby reducing the risk of errors in your financial planner.

Two Sides of Net Worth :

• A positive net worth means you own more than you owe.

• A negative net worth means that you owe more than you own. A hefty mortgage, student loans, or steep credit card debt could send you down into negative territory.

Al the people on Forbes rich list are also ranked by examining their net worth.

I tirelessly recommend the book on personal finance if you want to increase your net worth by gaining your financial education one of the best books that I found very useful is Rich Dad Poor Dad by Robert T. Kiyosaki.

In this book, there are a lot of basics where Robert talks about cash flow, assets & liabilities which is very important to know if you want to be successful.

If you want more lists then check out our article on 21 Best personal finance books for 20 Somethings.

Now let’s dive in a little bit on how is a person’s net worth calculated using an excel spreadsheet.

How to calculate someone's Net Worth In Excel Using Free Template

Before we jump into the calculation part I just want to give you some brief information about 2 things.

Which will decide what is your actual Net Worth. one is Assets that you own and has some value and the other one is liabilities which you own like mortgage, students loans all that stuffs.

And to calculate your Net Worth simply enter the value of all your assets on the given assets columns.

You can replace your titles and other things as well if you want to and fill up your liabilities on the excel template which we are going to provide you just in a second and watch the magic happen as it runs your data through our net worth equation!

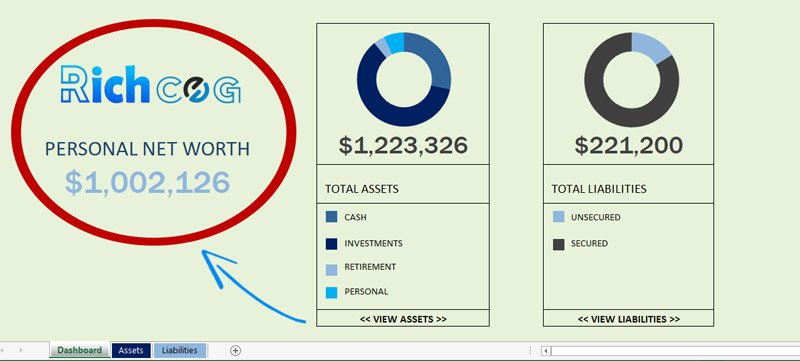

You can see something like this in the picture below after the whole calculation process!

Wait Wait, Don’t worry it’s not my Net Worth so calm down after looking at those numbers, maybe someday not this time around!

It’s not like you just end up reading a Millionaire Fastlane and you became rich overnight. It’s an excellent book though I recommend it to everyone who wants to boost their speed on increasing wealth, it takes a lot of work to be there so keep working.

Let’s come to the article now.

Calculating your net worth is a very basic process but it requires you to devote some time and gather all the information about your current assets and liabilities.

This is because the actual definition of net worth is the amount of money you’d have in hand if you sold all your assets and paid off all liabilities today.

That’s why I made these categories to help you much further and understand better, even though you don’t know anything.

Let’s see what we have to consider before putting numbers on those columns.

What We Should Consider While Calculating Net Worth?

Collect the following information before you do your Math:

- Real estate ownership papers

- Current registered and non-registered investment statements

- Current values on recreational vehicles and automobiles

- Bank account statements

- All mortgage statements

- Credit card statements

- Student, automobile, bank loan, credit line, and personal loan statements

- Life insurance statements

Once you have collected all your information, you can begin calculating your net worth by starting with a list of all the assets you own, which has a value of its own.

Let’s dive into a little bit to understand what are those assets includes?

First List All tangible assets

Tangible assets are items of value with physical properties. In other words, these are assets that you can touch. List and assign dollar values to all tangible assets such as:

- Residence

- Vacation home

- Rental properties

- Investment real estate

- Furniture

- Cars

- Sports or vintage automobiles

- Recreational equipment such as boats, snow machines

- Art

- Jewelry

Add up the dollar value of all of these items to find your total tangible assets.

List equity assets

Equity assets are your ownership interests in businesses, including stocks held in retirement accounts.

List and assign dollar values to all equity assets such as:

- Stocks

- Variable annuities

- Limited partnerships

- Business interests

- Any retirement accounts such as a 401(k) or IRA

Add up the dollar values of all items to find your total equity assets.

List fixed-income assets

Next, you need to list your fixed-income assets. Your fixed-income assets include long-term investments that pay interest on a fixed schedule.

Fixed-income assets can include:

- U.S. government bonds and securities

- Municipal bonds

- Corporate bonds

- Bond mutual funds

Add up the dollar values of all items you own in this category to find your total fixed-income assets.

List cash and cash equivalents

Cash equivalents refer to short-term accounts and investments that can be cashed in for emergencies. Include all the cash sitting in your checking and savings accounts, as well as all other easily liquidated money market funds.

Typical assets in this category include:

- Checking account balances

- Savings account balances

- Money market mutual fund balances

- Certificates of deposit

- Other cash reserves

Add up the dollar values of these items to find your total cash and cash equivalents.

Once you have all of your assets listed, it’s time, to sum up, your total assets. To determine your total assets now it’s time for liabilities.

List your liabilities

Next, it’s time to list your liabilities. A liability is a money owed by an individual or business that decreases net worth. Where the liabilities include:

- Home mortgage

- Other mortgages, such as vacation property or rental property

- Home equity line of credit

- Home equity loan

- Auto loans

- Bank loans

- Student loans

- Personal credit line balances

- Balances on credit cards

- Personal loans

- Other debts or money you owe

After all of these now let’s see how is someone’s net worth calculated or you can do your own as well.

How Net Worth of a person is calculated Using Our Free Template?

This free excel template is very easy to understand you just have to put your numbers over there and just wait for the magic.

If you are also wondering about how do you calculate someone’s net worth? then you can estimate their Net Worth by the lifestyle they live or asking their relatives about their wealth.

This is still not a great idea but you can do it if you want to.

First, download our template from the popup link below or if it’s not showing there you can ⇒ download it from here ⇐ as well and we will calculate your Net Worth together.

Now, I assuming you have already downloaded our template. let’s fill in all the values that are needed to calculate your Net Worth using a spreadsheet.

- Step1) Open our free Net Worth calculator excel template.

- Step2) After opening the file click on the assets tab on the bottom.

- Step3) Now, you have already all your list of assets right? which we have discussed above fill those up just like in the picture and you will your total asset value.

- Step4) After that click on the liabilities column.

- Step5) Fill in all your liabilities like students loans, credit cards, etc.

- Step6) After that you can see your total liabilities.

- Step7) Now pray for god to see the magic! just kidding. after filling both assets and liabilities go to the Dashboard tab and Bang!!! Your Net Worth is calculated.

That’s, how is Net Worth of a person calculated. I added all the required formulas, if you want to change those titles and make your own category just like I mentioned above. you can do that, just figure out what works for you. if you get any problem while doing it you can put the comment on the comment section below.

What net-worth do you consider rich? Why?

Felix Dennis has written a book named - How To Get Rich. where he describes the sections and what range we should consider poor, middle class, rich, or super-rich whatsoever.

According to the Book.

How do you calculate someone's net worth & levels depending on how much Net Worth we own?

Let's check your position according to this level:

POOR 0 - 5OOK

Let's say you have a net worth, less than 500k & It is considered poor since most of the Americans and people worldwide are in this group. They eat cheap, they live with low means, and they are usually into debt since the expenses are more than income.

This group consists of small business owners or shopkeepers or the average Americans who are doing 9 to 5 jobs.

Which most people don't really love to do and there is no motivation, that's why I recommend an excellent book called "How to Enjoy Your Life and Your Job".

I am sure you will adopt at least one or two of the suggestions and immediately improve your enjoyment of your life and/or your job. Also, this would be a good book to give as a gift especially to someone who you feel needs cheering up.

MIDDLE CLASS 500K - 2M

These people are also salaried class and have either 9 to 5 or some businesses. The expenses are more than savings.

These people live paycheck to paycheck and most of the expenses go into necessities, loans, debts, etc rather than investments or generating more income.

UPPER CLASS 2M - 4M

The upper class consists of people earning huge but still from 9 to 5 or are small entrepreneurs like drop shippers, bloggers, Youtubers, etc.

The good thing about this category is - these people are more concentrated to start or invest in new businesses in order to grow wealth.

COMFORTABLE 4M - 10M

In this category, people here can retire anytime since they are able to save enough and have flowing cash into their portfolios.

People are CEOs or some drop shippers, self entrepreneurs, YouTubers, Bloggers who already have a huge number of followers and subscribers.

WEALTHY 10M - 30M

People in this group have high net worth since they are either business owners, traders, celebrities, or famous personalities. These people tend to spend huge on luxuries and mansions, private jets, expensive cars, etc.

LESSER RICH 30M

30M net worth are richer than wealthy but still, they are far behind truly rich. They own small luxury brands, businesses. People prefer to buy luxuries since they can afford them.

COMFORTABLE RICH 80M - 150M

A net worth of 150m is enough to start a number of businesses own clubs, luxury brands, mansions. people stop looking at the price tag before purchasing.

RICH 150M - 200M

This category is again for creators, not the buyers. they tend to invest in the business and invest big to get more huge returns. Some of them are even rich enough to buy sports teams.

SERIOUSLY RICH 200M - 400M

Owners of manufacturing units, rich sportsmen, rappers, top 5% group of sports or business. They preferably live in huge mansions with their own private jets, helicopters, etc.

TRULY RICH 400M - 800M

These are the groups of true entrepreneurs who invested hugely or made a business big enough to be invested by others. People in this group have their own private islands. mostly businessmen, sportsperson, or luxury brand owners are part of this net worth.

FILTHY RICH 800M - 2B

They are going to be billionaires or the next world's top business tycoons.

SUPER RICH 2B++

They have this much money $2,000,000,000.

Well, if you are more curious about owning a private jet, It will cost you around $30M. Good Luck!

Apart from salary how are people increasing their net worth?

People rarely increase their net worth solely by the only salary. Until you get a job in Google as a CEO like a Sundar Pichai.

Who has $2M annual income, still that's not a lot of money anyway.

A very good chance to increase your Net Worth, while doing a job is to save a portion of your salary to invest in real estate, stocks, bonds, or to start a business, etc.

But the question is how much time you can give yourself to learn about those things to build your wealth?

A second job will often provide the seed capital needed but there is a danger: if you throw yourself into your job or your second job too completely, you may convince yourself that THIS is what you should be doing.

No. Salary is a means to an end. Tattoo that onto your mind and keep thinking it. Educate yourself in everything that has to do with building your wealth. It takes a lifetime to learn this.

Know what to do in every situation. finally, when you see your investments, and you can eventually "quit your day job." But always plan on what to do if the investments went wrong that's why I always recommend you to have a multi-sources of income.

Apply the 60–40 rule in your life:

First, find the monthly income you need to live comfortably without sacrificing anything.

Let's assume it's $5000. Now 5000 should be equal to 40% of take-home salary ==> Salary = 5000*100/40 = $12.5K. So you have 60% of your monthly salary or $7.5K for increasing net worth. This is my 60–40 rule in simple terms & you can apply this rule depend on your income level.

Simple Steps to increase net worth?

Here are the simple steps and practices that you can do to increase your Net Worth.

- Try to increase your monthly income and your 40% salary would be able to cover all expenses. You may also need to upskill, change jobs or even do your current work better to get a better salary.

- Keep the first thing in your mind even if your expenses increase.

- Start to invest where you can generate passive income.

- Examples of Passive investments Like :

a. Let’s say you can invest 20% in equity

b. Invest 20% in reverse mortgaged property – you will be paid to live in the property allowing you to decrease rent expenses

c. Invest 10% in savings

d. Use the remaining 10% for any active/passive income opportunities – creating online courses, content creation, Youtube, blogging, travel journalism, publishing books, and more.

One of the most important things that you don’t wanna do is to don’t overinvest without remembering that inflation will destroy any savings. So grease up your investment vehicles through periodic reviews to account for inflation.